Complete Guide for Household Businesses to Pay Taxes via the eTax Mobile App

To use the features of the eTax Mobile application, users need to download the app on their smartphones via the App Store (for iOS) or CH Play / Google Play (for Android).

Search for the keyword “eTax Mobile” and download the app.

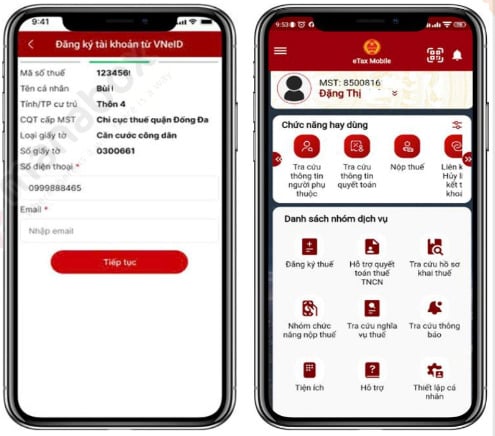

Log in using your Electronic Identification Account (VNeID) (Level 2 verification required) by following these steps:

Step 1: Select “Log in with Electronic Identification Account (VNeID).”

Step 2: Log in through the VNeID app.

Step 3: The system will verify your account:

-

If you don’t have an account on the Personal eTax system, the app will prompt you to enter additional details (phone number, email) to create one.

-

If you already have an account, you will be directed straight to the homepage.

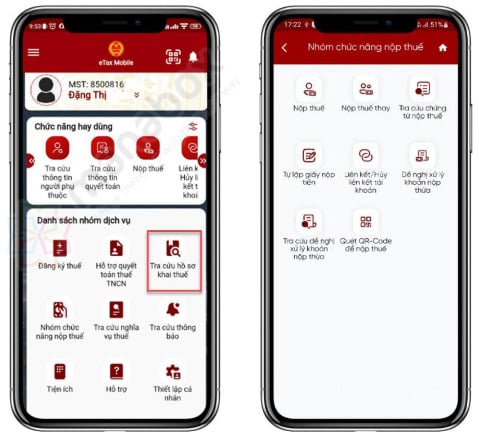

Below are the detailed instructions for household businesses to pay taxes using the eTax Mobile app:

(1) Tax Payment

Step 1: Tap the “Tax Payment Functions” menu → select “Pay Tax” → choose the “All” tab.

Step 2: Search using your Tax Identification Number (TIN) or the TIN of your business location/brand.

Step 3: Taxpayers can choose to pay all outstanding taxes or select specific items to pay.

Note:

-

Section 1: Payments must be made in the prescribed order. You can edit the total payment amount.

-

Section 2: Payments do not need to follow order; you can adjust each amount except for registration fees.

Step 4: Select “Create Payment Voucher” and proceed with payment.

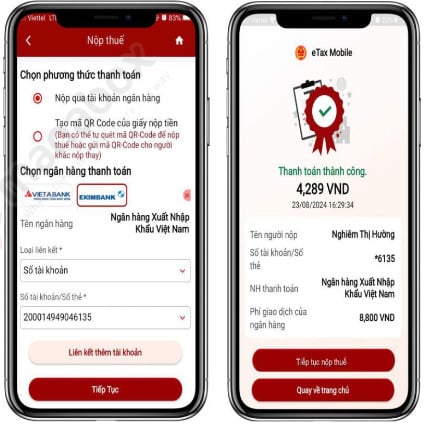

(2) Tax Payment (via Linked Bank Account)

Step 1: Choose “Pay via Bank Account.”

Step 2: Select a linked bank account.

Note: If no account is linked, the system will prompt you to link an account right on the payment screen. Tap “Continue.”

Step 3: The system displays the list of pending payment vouchers.

Step 4: Tap “Pay Tax” and confirm payment.

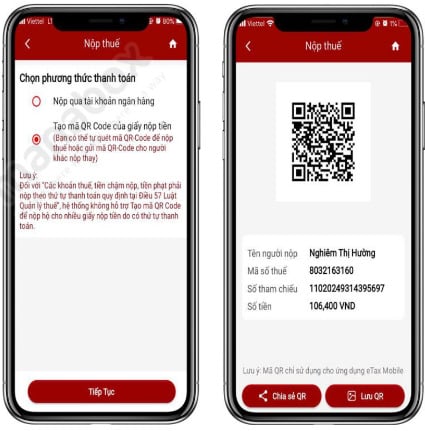

(3) Tax Payment (via QR Code)

Step 1: Choose “Generate QR Code for Payment Voucher.”

Step 2: Tap “Continue” — the system will generate a QR code for each voucher.

Step 3: Tap “Generate QR Code” to display a QR image containing payment details (taxpayer’s name, TIN, reference number, amount).

Step 4: Save or share the QR code with another person if they are making payment on your behalf.

Additional Features on eTax Mobile

Besides tax payment, the eTax Mobile app also provides:

1. Tax Payment Receipt Lookup

Step 1: Select the “Tax Payment Functions” menu → “Search Payment Receipts.”

Step 2: The system displays the search screen.

Step 3: Tap “Search” to display results.

Step 4: Select “Print Receipt” to view detailed payment information.

2. Tax Obligation Lookup

Step 1: Open the “Tax Obligation Inquiry” menu → choose “Tax Obligation Information.”

Step 2: The system displays the search screen.

Step 3: Tap “Search” to view the results.

3. Tax Notification Lookup

Step 1: Tap the notification bell icon or go to “Notification Inquiry.”

Step 2: The system will display official administrative notifications from the tax authorities.

Source: Vietnam Legal Library (Thư viện Pháp Luật)